Real estate investing can be a smart way to make money – for those who are prepared.

By Patricia Rivera

Content That Works

Aaron McDaniel entered real estate investing at 23 with a very different perspective from the one he has now. Like other first timers, he wanted to make money. Quickly.

He listened to brokers who told him that with his $50,000 annual salary he could afford to purchase a $500,000 property in San Francisco and rent it out to maximize his investment.

Within a year, the value of the home dropped to $170,000. McDaniel was left struggling just to make high balloon payments on the mortgage.

“I got caught in speculation before the crash and lost big,” recalls McDaniel, a serial entrepreneur and co-founder of the Access Investors Network, a mobile aggregator for equity and debt crowdfunding deals.

McDaniel picked himself up and went on to invest in real estate successfully — this time with more thought and selectivity.

He negotiated a loan payment for the first property and recalibrated. Instead of renting, he decided to focus on buying properties for rock-bottom prices and selling quickly. He purchased several homes at the bottom of the market, in the $150,000 range. He was able to remodel them and sell for twice the purchase price. Since then, he has moved into commercial property.

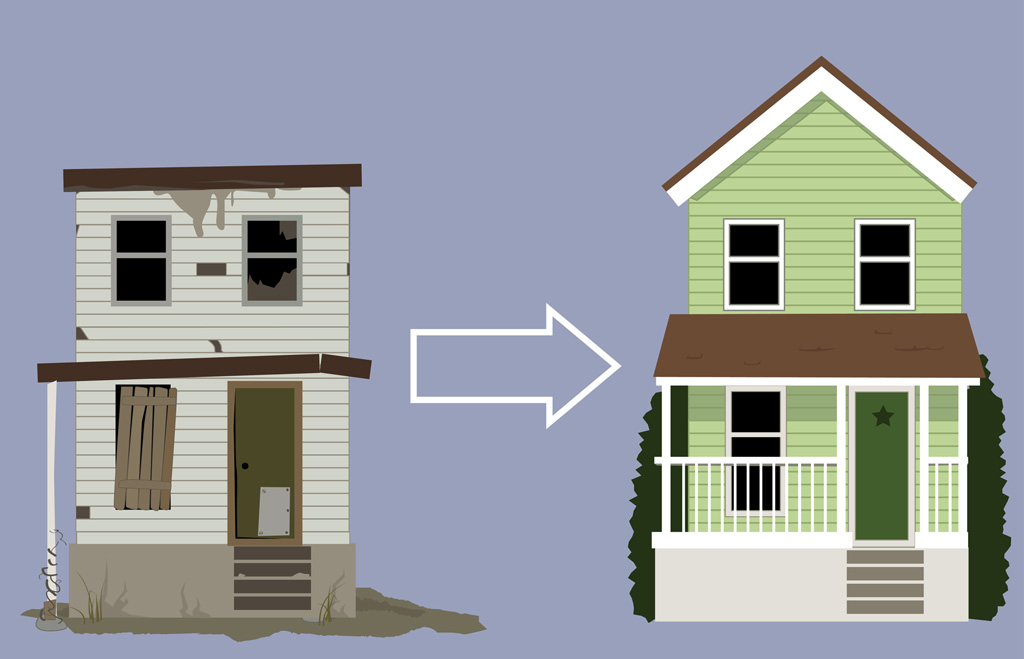

Popular TV reality shows depict the dramatic before-and-afters of entrepreneurs who fix, list, flip or rent, transforming a property from shack to showcase in just 30 minutes. Little wonder average folks get the itch, wondering if they, too, could flip or rent homes to make some extra money.

Experts say it can be done, but only with discipline and the right mindset.

“You have to treat your rental property business the same way a CEO would look at any other business, because that is what it is,” says Brandon Turner, a real estate investor and author of “The Book on Rental Property Investing,” (BiggerPockets Publishing, 2015). “Monitor your business’s health, hire the right people to do the right jobs and find ways to improve your bottom line.”

Looking back, McDaniel identifies his big initial mistake: a get-rich-quick attitude. Lesson learned. “I figured out that I couldn’t be greedy,” he says. “I had to work up to higher value properties slowly.” McDaniel learned to pace himself.

Eventually, when his advisors encouraged him to spread himself out a bit, buy more properties and take on more debt, McDaniel refused. He ignored those who promised to broker deals that just didn’t feel right.

Flipping houses or investing in rental properties requires a disciplined strategy. Before you start, consider these steps:

- Lay a firm foundation

Building wealth through real estate requires taking consistent action over a long period of time, Turner says. But before you can take action, you must develop a written business plan, even if it’s merely writing your strategy for achieving financial freedom through rental properties.

- What’s your strategy?

- What type of properties won’t you buy?

- What kind of properties will you buy?

- How often will you buy properties?

- How will you finance it all?

- Keep learning

Knowledge is power. Once you understand the basics of real estate investing, Turner says, keep learning, and keep a laser focus on your path. If your goal is to invest in rental property, don’t spend time thinking about fix-and-flip.

- Live by your metrics

Metrics determine how your property is performing. Sticking with them over time and using established metrics to measure your business will help you stay steady and reach success.

Important metrics, Turner says:

- monthly cash flow

- expense trend over 12 months

- appreciation of your properties in the past decade

© Content That Works