By Marilyn Kennedy Melia

CTW Features

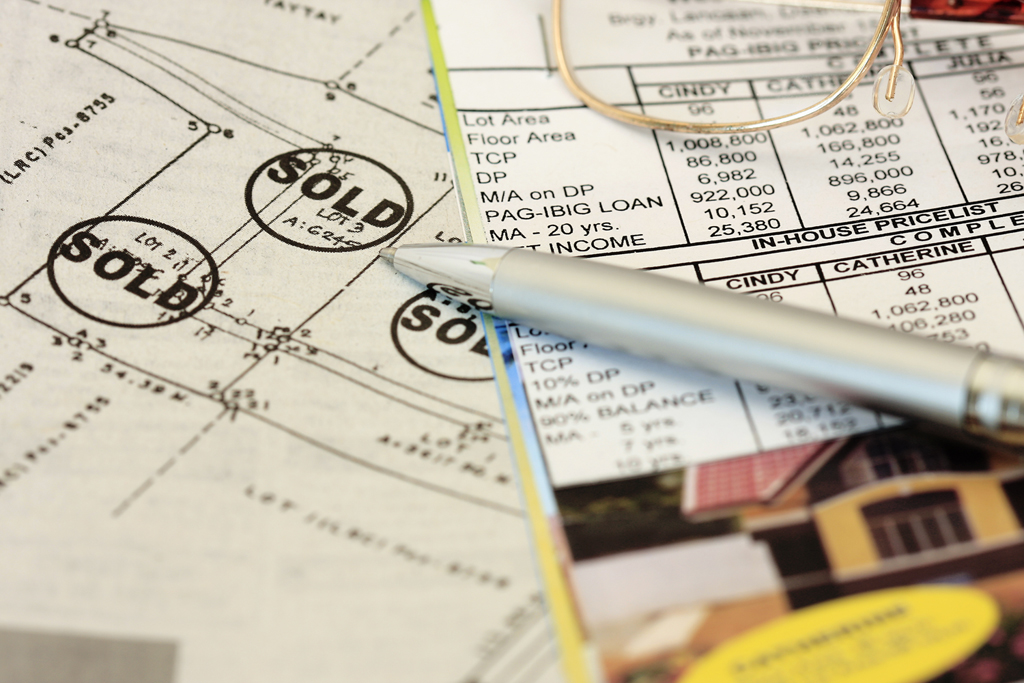

Before staking a “For Sale” sign, most owners spend considerable mental energy wondering how quickly their home will sell and at what price.

Then, on a crucial step, sellers might feel too rushed to read, much less think.

Today it’s common for listing contracts to be emailed, and electronically signed.

“I make sure they know what the basic terms are, like the commission charge and length of the listing agreement,” says Mary Liebrock, agent with the Northbrook, Illinois office of Berkshire Hathaway KoenigRubloff.

The paper traditionally involved in a home sale — the listing agreement, purchase offer, mortgage contracts and more — can now be zapped electronically, with buyer or seller just clicking, dragging and e-signing.

A 2016 National Association of Realtors survey found 86 percent of agents use e-documents.

In online shopping, consumers have become accustomed to quickly clicking and consenting.

But documents in home sales involve terms with significant implications. For instance, a contract may stipulate the buyer or seller to purchase insurance from a particular title company, notes Ralph Schumann, president of the Illinois Real Estate Lawyers Association.

All buyers and sellers should employ an attorney to review and negotiate the contracts, Schumann says.

And, don’t just skim and click. Schumann outlines some features sellers or buyers might find in a careful read:

- A listing agreement may stipulate that the sellers contract with the realty firm automatically renew, unless the seller cancels by a certain date.

- A disclosure outlining fees and rate are required to be sent within three days of when a borrower makes a formal loan application — study the disclosure to compare with final costs.

- A purchase offer should contain contingencies, like what will happen if it’s discovered that a property is in a flood plain or how real estate taxes will be pro-rated between buyer and seller.

© CTW Features